All Categories

Featured

Table of Contents

- – High-Performance Accredited Investor High Retu...

- – Innovative Accredited Investor Investment Netw...

- – Preferred Accredited Investor Investment Retu...

- – Trusted Accredited Investor Funding Opportuni...

- – Exceptional Exclusive Investment Platforms F...

- – High-Quality Accredited Investor Wealth-buil...

- – Trusted Real Estate Investments For Accredit...

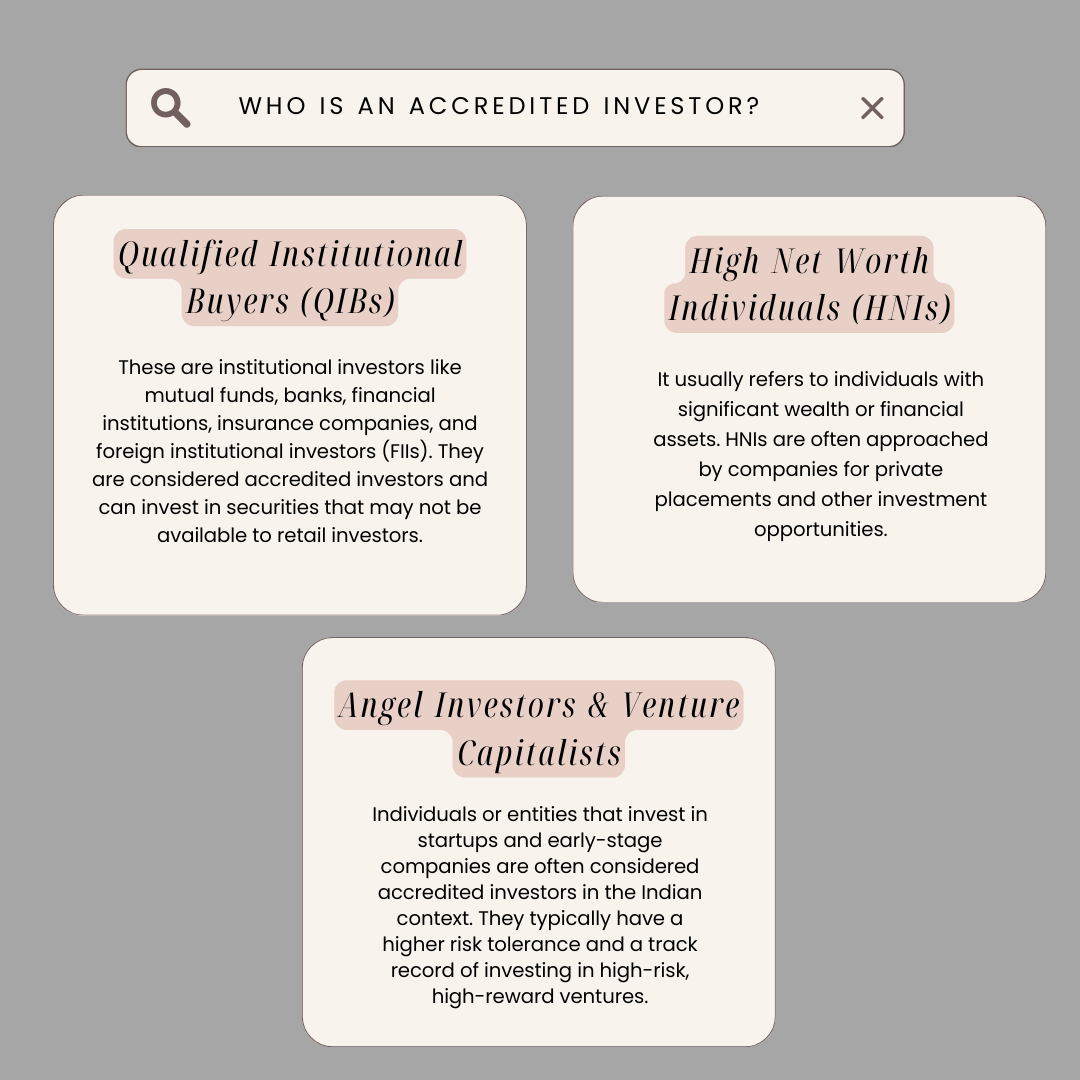

The policies for certified financiers vary amongst territories. In the U.S, the meaning of a certified financier is presented by the SEC in Policy 501 of Regulation D. To be a recognized financier, a person should have a yearly revenue surpassing $200,000 ($300,000 for joint revenue) for the last two years with the assumption of gaining the exact same or a higher revenue in the current year.

An approved financier needs to have a net worth going beyond $1 million, either separately or collectively with a spouse. This amount can not include a main home. The SEC additionally thinks about applicants to be certified financiers if they are general partners, executive officers, or supervisors of a firm that is issuing unregistered safeties.

High-Performance Accredited Investor High Return Investments

If an entity is composed of equity owners who are recognized capitalists, the entity itself is a recognized capitalist. However, a company can not be developed with the sole function of purchasing particular protections - exclusive deals for accredited investors. An individual can qualify as an approved financier by showing enough education and learning or work experience in the economic sector

Individuals that wish to be recognized financiers do not use to the SEC for the classification. Instead, it is the obligation of the business supplying a private placement to make certain that every one of those come close to are accredited investors. People or celebrations that desire to be accredited financiers can approach the provider of the unregistered protections.

For instance, expect there is a specific whose income was $150,000 for the last three years. They reported a primary residence worth of $1 million (with a mortgage of $200,000), a vehicle worth $100,000 (with an exceptional financing of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

This person's internet well worth is exactly $1 million. Since they meet the internet well worth demand, they certify to be a certified capitalist.

Innovative Accredited Investor Investment Networks

There are a few less usual credentials, such as managing a depend on with even more than $5 million in possessions. Under federal safety and securities legislations, just those who are certified capitalists may take part in specific protections offerings. These might include shares in personal placements, structured products, and personal equity or bush funds, to name a few.

The regulatory authorities wish to be specific that participants in these extremely dangerous and complex financial investments can take care of themselves and judge the dangers in the lack of federal government protection. The certified capitalist rules are designed to secure prospective investors with restricted financial understanding from adventures and losses they may be ill outfitted to hold up against.

Certified capitalists meet qualifications and expert requirements to accessibility special financial investment chances. Designated by the United State Stocks and Exchange Payment (SEC), they obtain entrance to high-return options such as hedge funds, financial backing, and exclusive equity. These financial investments bypass complete SEC enrollment however lug greater threats. Certified investors should fulfill earnings and net well worth needs, unlike non-accredited people, and can spend without limitations.

Preferred Accredited Investor Investment Returns with Accredited Investor Returns

Some crucial adjustments made in 2020 by the SEC consist of:. Including the Collection 7 Series 65, and Series 82 licenses or other credentials that reveal economic knowledge. This modification recognizes that these entity types are usually utilized for making financial investments. This modification recognizes the proficiency that these staff members create.

This adjustment make up the effects of rising cost of living over time. These amendments expand the recognized capitalist swimming pool by around 64 million Americans. This broader access supplies much more opportunities for capitalists, however also boosts possible dangers as less financially innovative, financiers can take part. Organizations using private offerings may gain from a larger pool of possible capitalists.

These financial investment options are special to accredited investors and institutions that certify as a certified, per SEC guidelines. This provides accredited financiers the opportunity to invest in emerging companies at a stage before they take into consideration going public.

Trusted Accredited Investor Funding Opportunities

They are considered as investments and are available just, to certified customers. Along with well-known firms, certified investors can select to buy start-ups and promising ventures. This uses them income tax return and the opportunity to enter at an earlier stage and possibly gain incentives if the firm prospers.

Nevertheless, for investors available to the risks included, backing startups can bring about gains. Many of today's tech firms such as Facebook, Uber and Airbnb came from as early-stage start-ups sustained by recognized angel investors. Advanced capitalists have the opportunity to discover investment choices that might produce more profits than what public markets use

Exceptional Exclusive Investment Platforms For Accredited Investors for Accredited Wealth Opportunities

Returns are not guaranteed, diversity and profile improvement alternatives are expanded for capitalists. By expanding their portfolios with these increased financial investment avenues recognized financiers can enhance their approaches and possibly achieve premium lasting returns with correct threat management. Experienced capitalists frequently experience financial investment choices that may not be easily available to the general financier.

Financial investment alternatives and safeties offered to approved investors generally involve higher risks. As an example, exclusive equity, financial backing and bush funds often concentrate on buying assets that bring danger yet can be sold off quickly for the opportunity of greater returns on those dangerous financial investments. Researching before spending is essential these in situations.

Lock up periods avoid financiers from withdrawing funds for more months and years on end. Capitalists may battle to properly value private assets.

High-Quality Accredited Investor Wealth-building Opportunities

This adjustment might extend recognized investor status to a variety of people. Updating the revenue and property standards for inflation to ensure they reflect modifications as time progresses. The present limits have actually stayed fixed because 1982. Allowing partners in committed relationships to combine their sources for common eligibility as accredited financiers.

Making it possible for people with certain professional qualifications, such as Collection 7 or CFA, to qualify as certified financiers. Developing additional demands such as evidence of monetary proficiency or efficiently finishing an approved capitalist exam.

On the various other hand, it might additionally result in seasoned financiers assuming excessive risks that might not be ideal for them. Existing accredited capitalists may deal with increased competition for the best financial investment possibilities if the pool expands.

Trusted Real Estate Investments For Accredited Investors

Those that are currently thought about certified investors should stay upgraded on any type of alterations to the standards and guidelines. Their eligibility may be subject to alterations in the future. To preserve their condition as accredited financiers under a changed meaning modifications may be required in riches management methods. Companies seeking certified financiers need to remain alert about these updates to ensure they are bring in the right audience of capitalists.

Table of Contents

- – High-Performance Accredited Investor High Retu...

- – Innovative Accredited Investor Investment Netw...

- – Preferred Accredited Investor Investment Retu...

- – Trusted Accredited Investor Funding Opportuni...

- – Exceptional Exclusive Investment Platforms F...

- – High-Quality Accredited Investor Wealth-buil...

- – Trusted Real Estate Investments For Accredit...

Latest Posts

Back Taxes Owed On Homes

Homes Tax Foreclosure

Property Tax Foreclosure New York State

More

Latest Posts

Back Taxes Owed On Homes

Homes Tax Foreclosure

Property Tax Foreclosure New York State